For anyone working in the nonprofit space — or for anyone who sends or receives online payments, for that matter — PayPal has become a bit of a household name.

It’s straightforward, it’s convenient, and for the most part, it gets the job done.

But does that mean it’s the best option for your organization with your unique situation and needs? After all, there are a lot of things to consider when selecting your online payment service provider. Or maybe you’re not even accepting online payments for your nonprofit at all right now. If that’s the case, you could be missing out on a major number of donations.

But if you’re reading this article, you likely already know that you need to select the perfect online payment provider for your nonprofit.

Luckily, you’ve come to the right place. Read on to find out more about both PayPal and alternatives to PayPal for nonprofits.

Overview of PayPal for Nonprofits

PayPal is a well-known, easy-to-use digital payment platform built for business, charitable, and personal use.

With its quick set-up process and the ability to send and receive multiple currencies all around the world, it’s a popular choice for organizations looking for a donation payment gateway and payment processor all rolled into one (for more information on payment terminology, check out our complete guide to understanding online payment services).

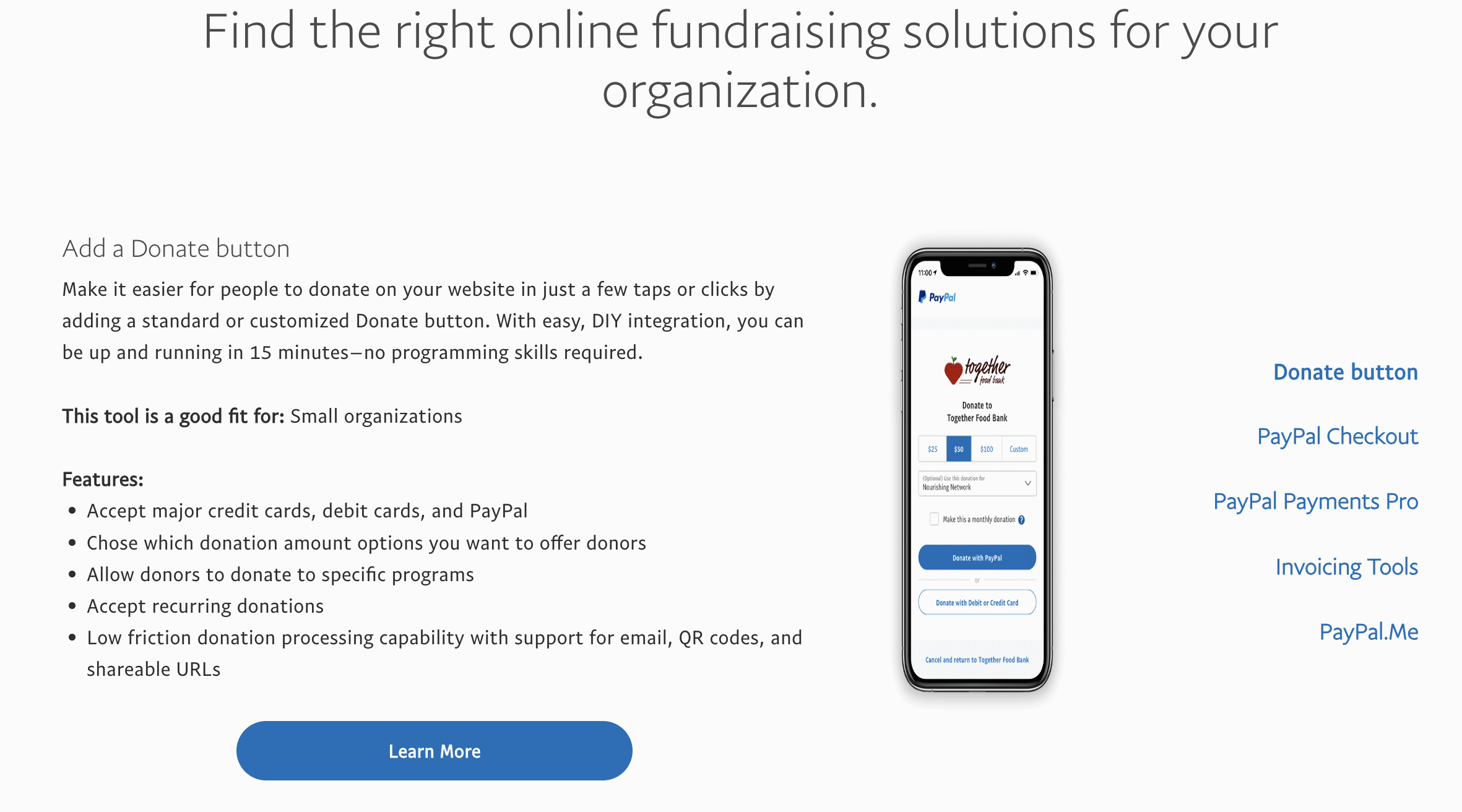

And as a comprehensive payment service provider, PayPal has something to offer organizations of any size, from donate buttons to checkout pages to pro payments.

But the one question we get asked from organizations over and over again…

“Payment providers can get really expensive. Is PayPal free for nonprofits?”

The short answer: no.

BUT if you can verify your organization’s charitable status — in the United States, for example, this means proving that you’re a 501(c)3 nonprofit organization — you’ll be able to take advantage of their special charitable rates with no setup, statement, withdrawal or cancellation fees.

This means paying 1.99% + fixed fee (based on your country – US is $.49) instead of the 2.89% + $0.49 per transaction that an unverified nonprofit would pay in the U.S.

3 Pros and Cons of Using PayPal as a Donation Platform

However, like anything, PayPal has its pros and cons. I’ve outlined three of the biggest for you below.

Pros of PayPal for Nonprofits

1. It’s the Popular Kid in School

PayPal is one of the most widely-used payment processors on the market, so there’s a good chance your donors have already used it or even have their own accounts. This removes a potential objection they might have and makes it just that much easier to accept donations.

But in case you were concerned, donors don’t need their own PayPal account in order to donate via PayPal. It works as a third-party payment processor, so it can accept most major credit cards, including Visa, Mastercard, and American Express.

2. It’ll Keep You Safe

PayPal handles all of your customers’ payment details itself, meaning you don’t have to store any sensitive information on your server.

PayPal also offers purchase protection in the case of fraudulent transactions.

3. Get Started in 1, 2, 3

There’s no doubt about it — PayPal is a user-friendly tool with an intuitive interface that just about anyone can get up and running.

And even if you do get stuck, PayPal has extensive online resources and customer support that’ll solve your problem in no time.

Cons of PayPal for Nonprofits

1. It’s Not Always the Cheapest Option

PayPal doesn’t have initial set up or monthly subscription fees in order to use their services, but there are a few areas where there are unique payment processing fees you should be aware of.

For example, if you’re a U.S.-based nonprofit accepting U.S. dollars from someone outside the U.S., then the fee you’ll pay will actually be 4.39% + $0.49 per transaction, instead of the domestic rate of 2.89% + $0.49 per transaction.

There are different fees for foreign currency conversion, in-person donations, and more, so it’s important to understand the fee structure for the services you’re planning on using to avoid any costly surprises.

2. Visitors Might Not Stay

PayPal is a third-party solution. That means that, unless you have PayPal seamlessly integrated into your website (such as via a custom branded checkout with PayPal Complete Payments), making a donation via PayPal usually takes people away from your site and onto the PayPal payments page.

When this happens, they might not return to your site after they make their donation, or they might fall off midway through and not donate at all.

3. Not Everyone Can Use It

Although PayPal is available in over 200 countries and 25 currencies worldwide, there are still some markets that don’t allow transactions.

If you work in or accept donations from people in locations outside of PayPal’s domain, you may want to look for another platform to avoid losing potential funds.

7 Alternatives to PayPal for Nonprofits

Feeling like Paypal might not be right for your organization? Here are five other options you might want to investigate.

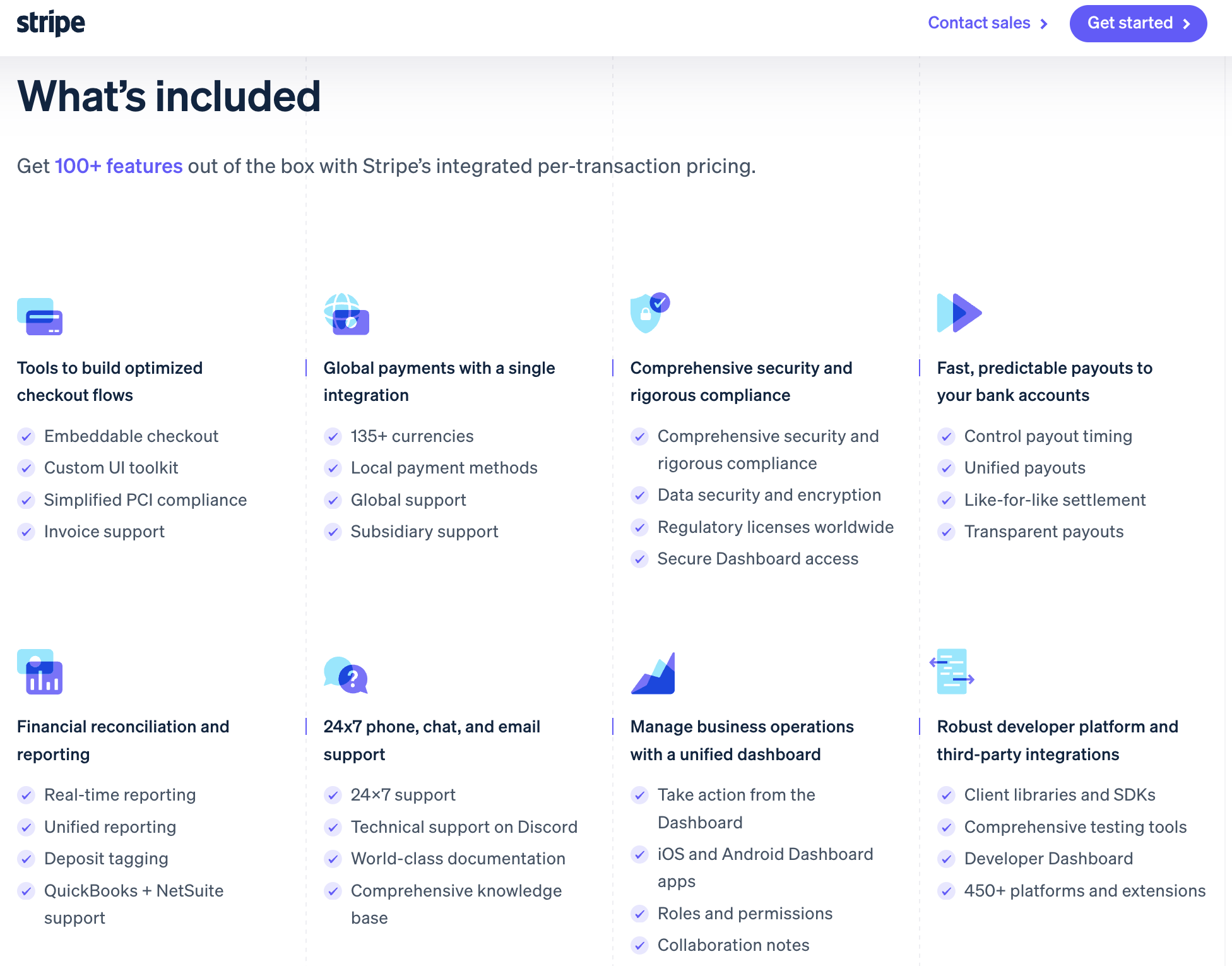

1. Stripe

Stripe is one of PayPal’s biggest competitors, and with good reason. It’s a global payment service provider that processes billions of dollars every year for businesses and nonprofits. It supports over 135 currencies and has a robust developer platform as well as a number of third-party integrations.

Rate: Stripe offers a discounted rate to registered nonprofits, but their standard pricing is 2.9% + $.30 per transaction.

Most notably, Stripe checkout forms are embedded directly into your nonprofit website, so donors aren’t directed to external sites to complete their transaction. The forms look modern and professional and guarantee a smooth donation process from beginning-to-end.

2. iATS Payments

iATS Payments is an online payment service provider that was founded specifically to help nonprofits raise money simply and easily. With over 20 years in business, today iATS works with over 16,000 nonprofit clients around the world.

It offers credit card, direct debit, and ACH processing for your nonprofit, all at varying rates, and integrates with dozens of nonprofit software companies you might already be using.

Although iATS stands for International Automated Transaction Services, iATS only accepts credit card donations from about 40 countries, and only accepts direct debits from Canada, the United States, and the United Kingdom, so if you have a large international donor base, you may want to look into another option.

Rates: Available upon request. Contact their sales department for details.

3. Venmo

Venmo is the #1 most affordable option for payment processing for nonprofits. Chances are you already use it for your day to day transactions with friends and family. This is a great option for those looking to get attention from a younger group of donors.

It’s easy to use, just set up a Business Profile to get started. But if your nonprofit is 501(c)3, you can set up a Charity Profile (after creating your Business Profile) to use Venmo for nonprofits!

Rates: 1.9% + $0.10 transaction fee per donation received.

- Contactless payments accepted with Tap to Pay on iPhone or Tap to Pay on Android have a slightly higher transaction fee rate of 2.29%+$0.10 of the payment total

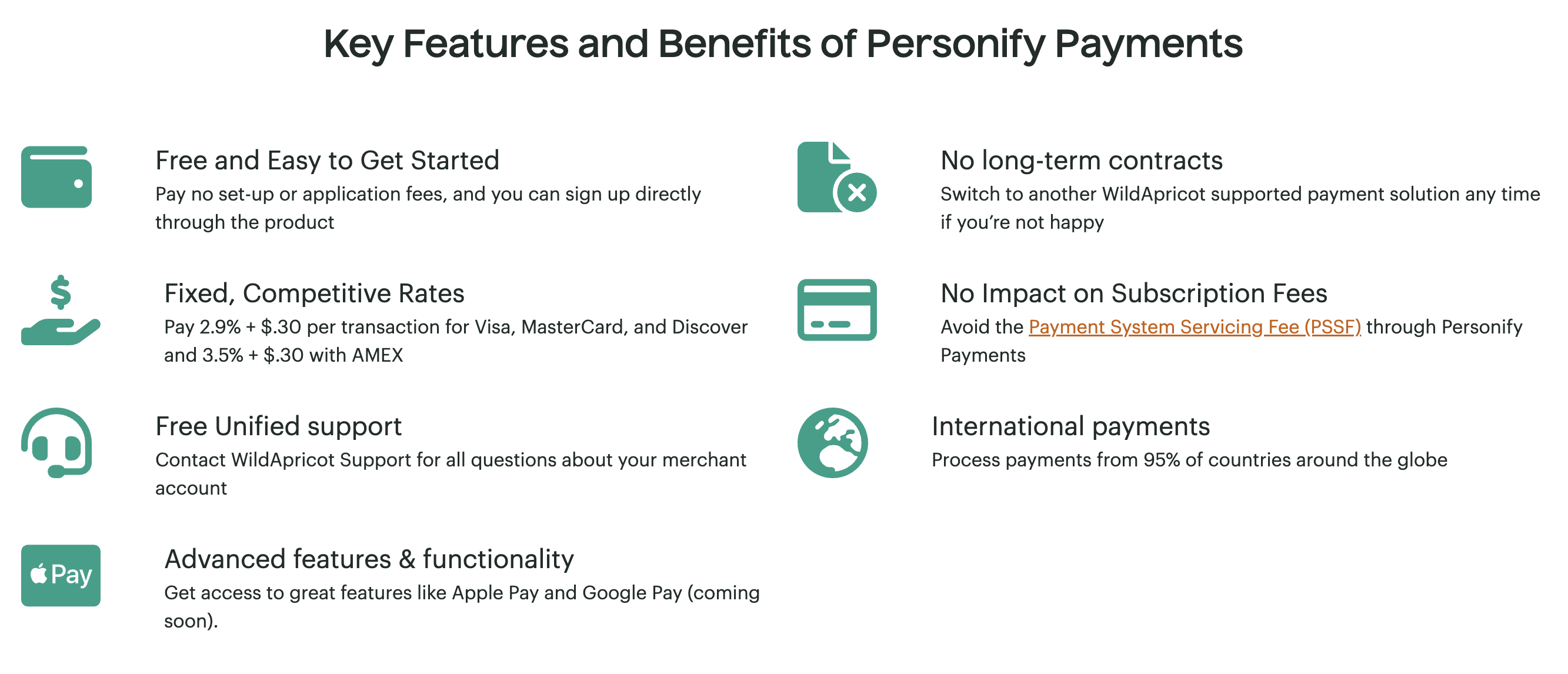

4. Personify Payments

Personify Payments is WildApricot’s own alternative to PayPal, available to paid WildApricot members. Personify Payments is WildApricot’s integrated payment processing system, a solution built for security, compliance and ease of use.

Personify Payments is fully PCI compliant. With Personify Payments, you can seamlessly accept online payments for membership, events, donations, and other sales, and in the process, manage your entire merchant experience through WildApricot without the involvement of a third-party payment processor.

Rates: 2.9% + $.30 per transaction (3.5% + $.30 per transaction when using American Express).

If you’re already a WildApricot client (and in the US), you can apply for a Personify Payments account here.

Not a WildApricot client but you want to be? Join over thousands of other nonprofit organizations and start a free 60-day trial now.

5. Snowball Fundraising

Snowball Fundraising is a donation software with advanced productivity tools, and specializes in features like text-to-give and auctions for fundraising. Trusted by over 15,000 nonprofit organizations, it’s a commonly used alternative to Paypal with its flexible pricing tiers depending on your size.

This all-in-one fundraising software is a great option for those wanting more than just a payment processor. Snowball has features like Supporter Outreach to help you nurture your donor relationships with outbound text messaging, marketing emails and interactive QR codes.

Rates: Starts at $0 monthly, 2.9% + $0.30 per transaction.

6. Square

Square is an easy to set up processor that allows you to accept online donations, in-person payments, through a payment link or with social media buttons.

Square gives secure payment processing with security features like: active fraud prevention, PCI compliance, dispute management, end-to-end encrypted payments and live phone support.

Rates: Square offers a variety of pricing options depending on how you process payments.If you accept most of your donations in person, it has one of the lowest processing fees!

- In-person: 2.6% + $0.10 per transaction

- Online: 2.9% + $0.30 per transaction

- Manual (for over the phone!): 3.5% + $0.15 per transaction

- Invoices: 3.3% + $.30 per transaction

7. Authorize.Net

Authorize.Net is a payment solution that’s actually powered by Visa. It has also been in business for more than 20 years, and is a trusted payment provider for businesses and nonprofits alike.

Through Authorize.net, you can easily accept donations and boost your fundraising efforts. Features like Customer Information Manager allows you to let returning donors pay easily without re-entering payment details.

If your nonprofit processes more than $500,000 in donations annually, you may be eligible for a discount with their enterprise solutions, but for most small nonprofits, that’s not going to be available.

Rates: 2.9% + $0.30 per transaction and an additional monthly fee of $25.

Wrapping Up

As you can see, there are multiple different options to choose from when it comes to processing donations. Whether your donor’s preferred payment method is credit card transactions, debit card payments, Google pay, Apple Pay, bank transfers or ACH – there’s a nonprofit payment processor for you in this list.

No matter what solution you choose for you nonprofit, your fundraising efforts need to be supported with donor management tools. Consider using a donor management software to help you reach your fundraising goals. This software will allow you to connect with potential donors and increase your donor engagement by allowing you to manage relationships with your supporters. Build meaningful relationships with donors, improve retention rates and increase fundraising revenue with a wide variety of donor management features.

Read more on Donor Management Software here and add more to your box of fundraising tools.