As a nonprofit, it’s a good idea to have a variety of revenue sources to fund your missions. One source can be grants. And if you’re looking for support for a specific project or position within your organization, you may have grant writing on the brain.

If you’re new to this process, you could have a lot of questions: How do I start grant writing? Is grant writing difficult? What does grant writing consist of?

Well, you’ve come to the right place! Below, we’ll cover everything you need to know about grant writing:

- Key essentials about grant writing

- Tips, tricks, and strategies

- A grant application template to get you started

In no time, you’ll be well on your way to writing your first grant!

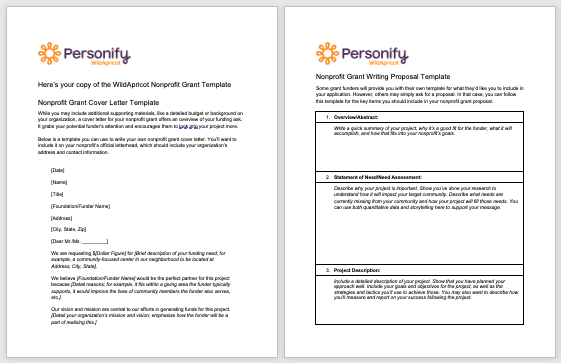

Looking for templates you can use for your grant application? Download our FREE Grant Application Template bundle, which includes:

- A cover letter template

- A grant proposal template

Fill in the form below to get your copy!

Download Your FREE Grant Application Template

What Is Grant Writing?

Grant writing is the process of writing a grant. But, you might wonder, what is a grant? A grant is a funding opportunity that foundations, businesses, and individuals make available to nonprofits to support their missions. It’s like a cash award for a great idea!

Grant writing is about building the case for a potential funder to support your work. Writing a grant involves putting together a proposal that tells the grantmaker the details of your project idea, how much money you need to fund it, and the impact it will make in the community.

You might also need to write a cover letter, but not all grant applications require one. We’ll dive into that more later in this article, so stay tuned!

Different Types of Nonprofit Grant Writing

You may find yourself writing for different types of grants. Some support specific project types, causes, or neighborhoods. Others may take a broader funding focus and accept proposals for any activity supporting the “public good.”

As you’re researching grants to apply for, you’ll want to be familiar with the three main types of nonprofit grants:

- Operating support or unrestricted funding: This kind of grant supports the day-to-day operations of your work. Unrestricted funding is the bread and butter of any nonprofit! If you snag this type of grant, it means the grantmaker trusts you to use the funding for whatever best supports your nonprofit rather than for specific line items or projects. These grant funds can be hard to find, since funders tend to like measuring impact through specific projects. But if you stumble across one, receiving it can make a huge difference to your nonprofit’s work!

- Capital support: Think of capital support as brick and mortar funding! These grants help your nonprofit purchase, renovate, or build needed facilities. They’re often for larger amounts. Because of that, they can require some extra details. Mainly, you’ll need to show the grantmaker that they can trust you to use it well!

- Program development grants or restricted funding: Have a specific project or staffing position to fund? These grants are restricted to specific purposes, so are a great option for those needs. For example, you might write a grant to fund a new after-school art program. Based on the grantmaker’s restrictions, the grant might cover the costs of purchasing paint, paper, and other art supplies to use in the program, but not the rent for the space where you’re hosting it.

Why Is Applying for Grants Important? Is it Right for Me?

There are several reasons why grant writing is important. Grant writing can:

- Diversify your sources of revenue: Having a variety of revenue sources helps prevent financial emergencies. If one stream dries up, other sources are there to support you. Grants can give your nonprofit something to fall back on should, say, your individual donor contributions decrease during an economic downturn.

- Serve as a source of non-dues revenue: If you’re a membership organization, grant writing lets you secure funding outside of dues. You can use this funding to create better programming to recruit more members to your organization. Win, win!

- Help carry out what may seem like big dreams, programs, or initiatives: Sometimes a sizable grant set aside for a specific purpose is the resource you need to finally see a big project through. This is especially true if you’re already running a tight ship with your day-to-day expenses and don’t have the wiggle room to expand. Continuing with the art program example, a grant could help you buy a new kiln to start a ceramics program or fund an artist-in-residence program.

- Offer funding without a required payback period: Particularly for capital projects, grants can provide a solution to what you might otherwise have to finance through a loan. It definitely takes strain off your budget to avoid monthly loan payments!

- Increase the visibility of your organization: A lot of times, grantmakers will share press releases on which nonprofits they fund. They may also share your work on their social media and other marketing channels. This added bonus to the funding helps you reach a wider audience.

- Increase the credibility of your organization: Have you ever trusted a business or organization more because a peer recommended it? So many of us do—including grantmakers!. As you find success with your grant writing, you build your nonprofit’s credibility and it may become easier to secure additional funding in the future.

How do I know if applying for a grant is right for me?

While any nonprofit, big or small, can apply for a grant, it’s important to keep in mind that grants are best for long-term projects and goals. If you’re looking for immediate financial aid, a grant won’t be able to support you the way you need. This is because the application cycle can be long, and you don’t want to be waiting if you’re in a pinch!

Where can I look for nonprofit grants?

There are many places you can look for nonprofit grant writing opportunities. Here are a few to get you started:

- Google Alerts: Set up a Google Alert to receive a notification whenever new opportunities come up for your selected keywords. For example, if you’re funding an after school art program, you might set up alerts for “art program funding opportunity,” “after school art grants,” or “art grants for children.”

- Government-Based Grant Foundations: Your state, province, or country will usually have a database for grant writing opportunities. If you’re based in the United States, Grants.gov is a great place to start.

- Search Engines: You can find a lot of opportunities with some simple search engine research. Use keywords like the same ones you’ve used to set up Google Alerts.

- Your Existing Network: You may have current donors or members who serve on foundation boards or run their own philanthropic opportunities. Reach out to your supporters and ask them about grants they know of that could fit your nonprofit.

- Board Members: Board members are another great resource. See if the companies they work for offer grant writing opportunities. They may also have connections at other foundations or to friends in their network who offer grants to nonprofits like yours!

- Other Nonprofits: Need some ideas on who might fund you? Take a look at nonprofits similar to yours to see where they’re getting their funding.

- GrantWatch: GrantWatch is an online database that keeps current information on available grant writing opportunities within 60 different categories. It makes it easy to search for grants that could be good for your nonprofit.

- GuideStar: This online database provides information on nonprofits everywhere. It’s a great way to identify similar nonprofits to yours and see where they’re receiving their grants. You can also use it to identify foundations that provide grants and learn more about them and who they have funded in the past.

- Philanthropy News Digest: This free online service posts requests for proposals and grant notices for US-based nonprofit and grantmaking organizations. You can sign up for its newsletter and alerts and easily view the most recent opportunities by category and application deadline.

- Candid’s Regional Giving Dashboards: This online service offers overviews of regional funding opportunities across the United States. Not based in the US? Keep an eye on it, as it may expand to include global opportunities in the future as well.

Essential Elements of a Grant

Usually, the two core elements of a grant are the grant proposal and the grant cover letter. Below, we’ve covered the essential parts of each of these components.

Nonprofit Grant Writing Cover Letter

Depending on your grant application, the cover letter may not be necessary. However, if your grant writing involves a cover letter, it should typically be one page in length and written on your nonprofit’s official letterhead.

Your cover letter is an overview of your funding ask. It grabs your potential funder’s attention and makes them want to look into your project. Think of it like a friendly elevator pitch that lands you an interview to learn more!

Here’s what you’ll typically want to include in your cover letter:

- Brief project description

- Expected impact of the grant

- Requested grant support amount

- Outline of what is included in your attached proposal

- Mention of past grants you’ve received

- Your contact information

- Signature of your Executive Director or Development Director

Nonprofit Grant Writing Proposal

If your cover letter is what gets your foot in the door for an interview, we can think of the grant proposal as what gets you the job!

Your grant proposal builds the case for why the grantmaker should fund your project. It provides essential, persuasive details that give heft to anything already mentioned in your cover letter. Some grant funders will provide you with their own template for your application. Others may simply ask for a proposal. Be ready for both!

What is included may vary slightly by funder, but typically a proposal involves:

- Overview/Abstract

- Statement of Need/Need Assessment

- Project Description

- Budget & Budget Allocation

- Organizational Background

- Supporting Documents

Tips and Strategies for Grant Writing

Whether you decide to use a template or decide to free-style it, there are some key tips and strategies you want to keep in mind. Grant writing can feel intimidating, so it’s important you go in with the right information. This way, you’ll have the confidence that you’ll be writing a strong application.

In this section, we’ll cover key pointers for each stage of grant writing, including:

- How to prepare for grant writing

- Grant writing strategy and planning

- Writing your grant

How to Prepare for Grant Writing

Before you even start mapping out your grant application, there are a few steps to take to prepare. You’ll want to:

- Understand the audience, purpose, and expectations of your grant proposal: Read as much as you can to learn who will be reading your grant application and what they’re looking for. Know the purpose of the grant funding and the expectations the grantmaker will have if you receive the award. This can even help you find the right person to address your cover letter to, making it a lot more personal than using “Dear Foundation” as your salutation!

- Tailor your proposal for a specific objective: Even if you’re applying for unrestricted funds, aim to be detailed in your funding ask. Framing your grant writing around a specific objective builds the case for why you should get the funding and the type of impact it’ll have for your nonprofit.

- Understand the application’s guidelines and rules and follow them to a tee: Grantmakers typically have many high-quality applications to review. It can be hard for them to narrow it down to a winner! Avoid simple mistakes that could move you from the “yes” pile to the “no” pile, like getting the time zone wrong for the deadline or forgetting to include supplemental materials. You want your hard work to have the best chance possible! Have questions about the grant application’s rules? Reach out to the grant officer for clarification. Asking questions isn’t a weakness! It shows the grantmaker you pay attention and care enough to submit the best application possible.

- Be realistic: As you review a grant’s guidelines, rules, and purpose, ask yourself whether your project is truly the right fit for that grant. There’s no need to waste your time writing the grant or the grantmaker’s time reviewing the application if your project doesn’t align with the grant’s goals.

Grant Writing Strategy and Planning

Before writing your grant, know what you need to cover within it. Having these answers before you start writing will make sure you cover the core ideas needed in your grant application. And ultimately, this makes sure you give the funder all the information they need to be convinced to award you the funding!

As well, during this stage, you’ll want to strategize and plan accordingly to make sure you’ve given yourself enough time. Set out time to draft and refine your grant application before your submission is due.

As you get started, make sure you know your answers to the following:

- What is YOUR grant application timeline? This is one of the first and most important questions to ask yourself. Know when grant application periods open and close. Consider whether you have one or multiple grants to write during that period. Then, create a timeline for yourself so you have ample time to prepare your application with minimal stress and to not miss a deadline!

- Why are you asking for the grant? From the beginning to the end of your grant writing process, focus on this question and build it into your entire narrative. Basically, you want to clearly know your need and how to convey it.

- What will the impact and benefits be? On top of communicating what your needs are, you should be able to clearly state how this grant will address them. Help your funder envision the future they will help you create!

- What will be your plan of action once you get the grant? Be prepared to start your project as soon as you receive the grant. Having a timeline for when different events and activities will occur demonstrates that you have an actionable plan to use the grant in a timely and effective manner.

- What is your financial budget and plan for the funding received? You should be prepared with a detailed budget for your project. Rather than asking for a lump sum of money, be able to explain the different pieces that go into creating that total. Using the after-school art program example, you’ll want to share how much funding will go toward paint, brushes, paper, staff time, marketing, and rent.

Writing Your Grant

As you actually start writing your grant, there are some tips that can help strengthen your application. To write a successful grant application:

- Be specific: Show that you’ve put thought and care into your funding proposal by being specific. For example, rather than saying you want to fund art opportunities for children, share how you will create those opportunities. You will begin an after school art program for children ages 5 to 10 in New York City that will employ three local artists who specialize in painting, collaging, and ceramics.

- Be concise: While you want to be specific, you also want to be concise. Don’t make the funder search for the most relevant information in your grant application. Make every sentence count.

- Avoid redundancy and repetition: One way to tighten up your application is to review it for repetition. Have you already explained something clearly in an earlier part of your application? No need to say the same thing again! If you’re building on it in a way that’s crucial to your application, keep it short and simple by adding a phrase like “as stated earlier”.

- Make a clear ask: Don’t be shy about making your ask! Clearly state your need. For example: We are asking for a $5,000 donation to support an after-school art program. You can also use bullet points to draw attention to your ask and make it easy to understand.

- Lead with your core idea: Start with your clear objective for the grant proposal and then make sure everything else you write links back to that core idea. Think of it as you would the thesis for an essay.

- Demonstrate your past successes: When relevant, feel free to brag on your organization’s past successes with grants a bit! Mention others you’ve received and how you’ve put them to use. This shows the grantmaker that in the past, others have seen promise in your projects or mission. It also shows you’ve been able to use that money to make a positive difference. Funders may be more likely to give to an organization that already has experience managing grant funds.

Start Grant Writing With Smart Preparation and Strategy

We hope you found this guide to grant writing helpful! Yes, getting started with grant writing can feel like a lot, but with some simple preparation and strategy, you can take the process step by step for a successful submission and award!

Want to keep up to date with other nonprofit tips? Make sure to check out other articles on our blog!

And if you’re looking for additional ways to diversify your nonprofit funding and sources of income, check out our resource How to Write the Perfect Donation Letter (+ Examples & Template).